Pros and Cons of Debt-Based Crowdfunding in Singapore: A Guide for SMEs & Investors

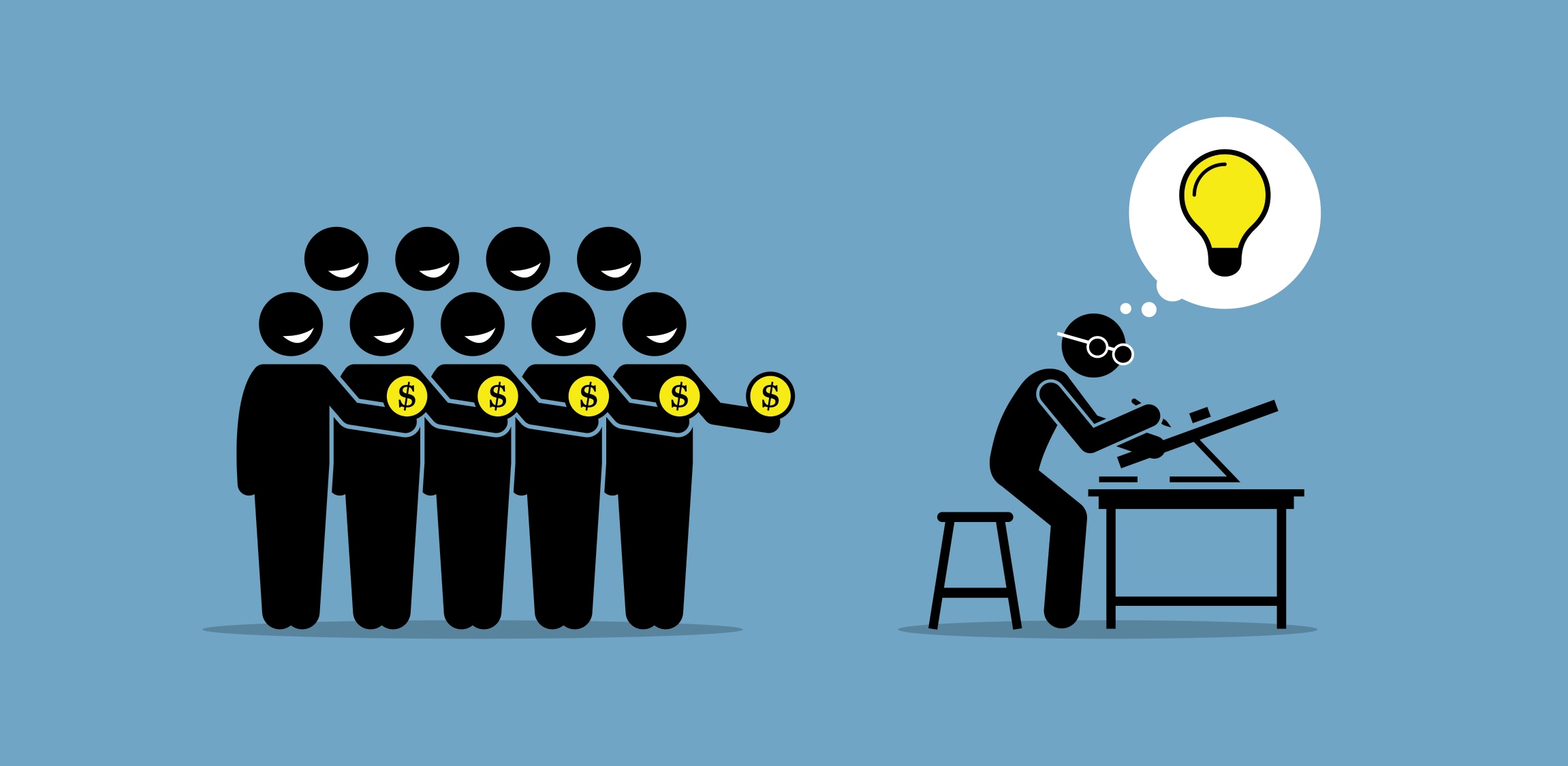

Debt-based crowdfunding has emerged in recent years as a way for small and medium-sized businesses (SMEs) to acquire much-needed working capital. It is also referred to as peer-to-peer lending. Essentially, retail investors directly fund the organisation they want to back, in exchange for interest payments.

Debt-based crowdfunding has emerged in recent years as a way for small and medium-sized businesses (SMEs) to acquire much-needed working capital. It is also referred to as peer-to-peer lending. Essentially, retail investors directly fund the organisation they want to back, in exchange for interest payments.

SMEs typically face tight cash flow in the early days of running a business, or during a time of expansion. Sometimes, it is simply the case of having to run the business while waiting for receivables to stream in. Instead of filing paperwork and getting approval for a traditional SME business loan, crowdfunding allows SMEs that are in dire need of working capital to acquire funds quickly.

Let’s delve further into how it works. We’ll also cover the pros and cons involved from the perspectives of SMEs as well as investors.

For Singapore investors: How does investing in crowdfunding work?

Crowdfunding comes in different forms. You may have heard of Kickstarter or Indiegogo, which are examples of reward crowdfunding. Investors back a promising prototype or venture, and they are promised rewards in the form of receiving the brand new invention or freebies.

Then, there is also equity crowdfunding, where you invest in a small business and receive a stake in it in the form of shares. When the business makes profits through their business, investors can then receive returns. Such investments were once reserved for very wealthy angel investors, but with crowdfunding, multiple investors can pool resources to invest.

Debt-based crowdfunding, which is the focus of this article, works in a similar way. SMEs sign up on a crowdfunding platform as borrowers. On the same platform, retail investors then select the businesses or the products and services offered that they want to invest in. Thus, investors are shareholders of the loan and they will receive interest payments when the business repays the loan.

So, answering the popular question: Can you make money investing in crowdfunding? The answer is yes for equity and debt-based crowdfunding. Such crowdfunding involves multiple investors, so the risks and profits are decentralised.

Undoubtedly, there are risks involved in P2P lending or crowdfunding. Some of these risks include loss of capital when the business defaults, possibility of fraud, having to sell at a loss due to a lack of liquidity, and failure of the crowdfunding platform itself. In Singapore, some risks are mitigated with MAS-licensed securities-based crowdfunding platforms. This is because these platforms are required to ensure proper segregation of investors’ monies, keep proper records of transactions, and deal fairly with investors, among other rules. Failure to comply will lead to their license being revoked.

That said, every investor should be careful to select a reliable crowdfunding platform with additional safeguard measures. It is an investor’s responsibility to conduct due diligence and be aware of the risks and potential returns. Look out for an MAS-licensed and reliable platform, such as BRDGE, which goes the extra mile to put in risk mitigation measures and conduct stringent due diligence checks on SMEs’ financial health and repayment ability to protect investors’ interest.

Pros and cons of debt-based crowdfunding (P2P lending) for investors

| Advantages | Disadvantages |

| Earn interest by backing local services and product | Default risk, where the business is not able to pay back the loan |

| Fully customisable portfolio | Inflation risk, where investments drops in value to due to inflation |

| Flexible loan amount and time horizon | Interest rate risks, which may undervalue investments |

| Chance to diversify investments | Fraud risk, where borrower is not legitimate |

| Liquidity risk, where investor needs to exit early and sell at a loss due to a need for liquidity |

The main advantages of debt-based crowdfunding for investors is a fully customisable and diversified portfolio, as well as the ability to earn interest by backing local services and products. For investors who invest with BRDGE, the crowdfunding investment returns in Singapore are 5% to 17% p.a.* Such investments also help local businesses overcome financial bumps like shortage of cash flow, which help them stay afloat. Risks include default risk, inflation risk, interest rate risk, fraud risk and liquidity risk.

Tang Mei Yee, who has been an individual investor with BRDGE since 2017 and recently invested a five-figure sum in BRDGE’s special F&B loan offered to SME F&B borrowers, explained that there will always be risks involved with investments but it is a matter of weighing the risks and benefits. Mdm Tang said: “My husband and I had some reservations with investing initially but were convinced after we thoroughly read through the F&B’s financial statements and the factsheet that BRDGE provided. It was well worth the risk for us to invest in their business ventures.”

While many are still on the fence about investing, and more so investing in the F&B sector during this volatile economy and climate, investors like Mdm Tang is of the belief that F&B has always been a lucrative business. “As the economy is slowly starting to recover, it is timely to support our local businesses especially after what they have gone through in the last two years,” Mdm Tang added.

The SME F&B borrower that Mdm Tang invested in required funds for business growth.

For Singapore’s SME borrowers: How does debt-based crowdfunding help your business?

SMEs need urgent working capital from time to time. This is even more true as Covid-19 continues to rage on. For the past two years, small businesses have been struggling to keep up with changes in restrictions and rules. When stricter measures were enforced, retail and F&B businesses had to face lower footfall but continue paying rent, payroll, and other expenses to survive.

Urgent working capital can help SME owners tide over such pressing but temporary periods of tight cash flow. But borrowing from the bank isn’t that easy. Taking up something like a DBS or OCBC SME loan often requires SMEs to complete extensive paperwork and offer up significant collateral. The approval process may also be long and not all SMEs can qualify. In fact, up to 50% of local SMEs are ineligible for traditional financing, either because they are too young and have a scant track record, or they have maxed out their line of credit from banks.

Pros and cons of debt-based crowdfunding (P2P lending) for SMEs

| Advantages | Disadvantages |

| Quick credit assessment | If the business unable to repay the loan within a certain time, the business may have to be liquidated |

| Fast turnaround of funds | Taking P2P loan may limit other financing options |

| Attractive interest rates | Possible additional fees on top of interest rate |

| Flexible loan amount and time horizon |

Debt-based crowdfunding platforms like BRDGE can conduct quick credit assessment and offer fast turnaround of funds within seven days. Although there are still processes in place to check your financial history and credit risks, for local SMEs, it may be less onerous than borrowing from traditional banks. Risks include failure to repay the loan, which may result in the business being liquidated. Taking a P2P loan may also limit other financing options.

As you can see, crowdfunding platforms connect SMEs to investors with benefits for both parties. SMEs can acquire funds for their businesses through quicker processes, which is important when in need of urgent working capital. Both SMEs and investors have the advantage of borrowing or lending a flexible loan amount over a specified time horizon.

Like every investment, the disadvantages are mainly risks, the key one being that the business is unable to pay the loan, and investors suffer from loss of capital. The SME owner, or borrower, will then have to liquidate his business. However, some of these risks, such as fraud risks, can be mitigated by selecting a trustworthy crowdfunding platform in Singapore.

BRDGE is a Singapore-based P2P lending and equity crowdfunding platform. Licensed by MAS since 2017. It currently has over 17,000 retail investors, backing 252 SMEs with funds between $20k to $250k per portfolio and has successfully funded over $74.7 million in total. The fast-growing community of investors and SMEs is enabled by an easy investment process for investors and a simple onboarding process for SMEs.

To sign up as an investor on BRDGE, click here.

To sign up as a borrower on BRDGE, click here.

*Actual returns may be lower than the expected rates of return, and historical returns may not reflect future returns.

Disclaimer: The information contained on this website is for general informational purposes only. The content in this article does not constitute investment advice. Please seek professional advice before making investment decisions. BRDGE accepts no liability for any decisions taken in relation to the above.

Get the guide now!

Get the guide now!